Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The current blockchain industry has not been short of ideas, but even over the course of the past 18 months, TVL has grown twofold quart after quart- $58 billion in Q4 2023, and nearly $120 billion as of May 2025 (2025 Messari Outlook). There is a well-established triumvirate of needs that that capital influx expounds on: decentralization, throughput, and resilient security. EigenLayer is bringing its restaking framework at this point, and it has a distinct message: how about we avail ourselves of the existing $100 billion-plus security net of ETH stakes in Ethereum and transform security slumber into an income generator? I recall when I tried an early dev-net in the fall of 2024 the gasp in the room was not about the promise of a higher APY, but was about what we saw in the confirmation when it dawned on everyone present: dozens of rollups in the network and not a single new validator spun up to do so. That aha is the reason why restaking is now at the center of most layer-two roadmaps.

EigenLayer is a middleware that is programmable and anchors to the beacon chain of Ethereum. The on-demand security API protocol enables builders to place ETH-backed slashing guarantees on their applications by letting builders deploy what they call Active Validated Services (AVSs), which assume ETH slashing guarantees. As opposed to a sidechain that forks an entire validator ecosystem, an AVS only adds additional rules a.k.a. think data availability proofs or oracle updates) to the original 32-ETH bond. The outcome is not just cost savings, but that economic power is now consolidated, such that a 51 % attack on any child service now becomes costly as an Ethereum attack. Effectively, EigenLayer transforms the Ethereum fortress security of a single tenant into a multi-tenant, as a skyscraper.

Disjointed sets of validators have historically pushed new chains into either of two sub-optimal options: paying inadequate security premium and being attacked or paying too high premium and stifling growth. The solution, which is the answer of EigenLayer, lays bare and beautiful in its simplicity: the newcomers can just rent the already existing army of validators that already protect the largest smart-contract network in the world. The three compounding benefits of this alignment are: 1) smaller projects get institution-grade security on day one; 2) validators accrue incremental fees without new hardware; 3) Ethereum itself becomes stickier, with every AVS becoming more dependent on its finality. Such interdependence might eventually track towards the network-effect flywheel that has made Linux the default server O.

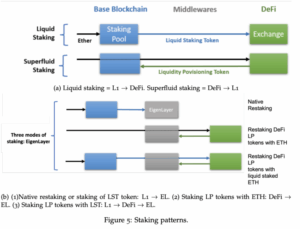

Restaking allows a validator of the Ethereum to secure the same 32 ETH not only in the beacon chain, but also in any AVS it joins. It can be seen as rehypothecating security instead of capital; the ETH does not go anywhere, but EigenLayer smart contracts act as ghostwriters to provide more slashable conditions. As of January 2025, Eigen Metrics dashboard reports that 27 % of all active validators, approximately 230 k, have already enabled restaking, moving aggregate safety over supported AVSs to a level equal to around 27 billion dollars. The practice, however, brings on stratified risk: a validator now has many penalty vectors to consider juggling. Wisely, the Ethereum Foundation simulations (Q3 2024) indicate that with correlation of faults less than 5 %, network-wide slash-events are an economic option.

In the classical proof-of-stake, validators are paid by each chain to contribute capital. The staking model inverts: a single stake can underwrite multiple protocols, and the capital efficiency of the system changes from about 20 % (single-use) to over 80 % (multi-use) when five [AVSs] are sharing a bond. To the developers, it implies that the marginal cost of bootstrapping security could decline 70-90 % compared to Cosmos-style sovereign chains (2025 Delphi Digital report). To validators, restaked rewards now constitute a significant portion of revenue; Lido in its April 2025 earnings call reported 14 % of node operator payouts already being paid by EigenLayer fees.

EigenLayer is a mix of two layers in the market: a pooled security layer and an open validator-service marketplace.

In the perspective of a validator:

The following table updates the early 2023 comparisons to reflect maturity as it affects costs and security dynamics with fresh 2025 findings.

| Metric (May 2025) | EigenLayer (on Ethereum) | Solana | Aptos | Rootstock | Cosmos (Zone Avg.) |

|---|---|---|---|---|---|

| Security Source | Shared ETH-stake ($100 B) | Stored in native SOL stake ($15 B) | Stored in native APT stake ($5 B) | Stored in BTC merge-mined | Stored in independent PoS ($38 B per zone) |

| Annual Sec. Cost* | $0.6 B (fees only) | $1.2 B | $0.4 B | $0.1 B | $0.2 B – $0.6 B |

| Modularity Score | 9/10 | 4/10 | 6/10 | 5/10 | 7/10 |

| Mean Number of Validators | 950 k (shared) | 1.8 k | 103 | 45 | 120-175 |

| On-boarding Time | less than 1 week (inherit security) | 6-8 weeks | 5-7 weeks | 8 weeks | 2-6 weeks |

*Approximate inflation + fee spending 2025 Electric Capital). Analyst composite scale.

Programs like the Espresso Systems sequencer (initiated Mar 2025) used EigenLayer, and approached >90 % Ethereum hash-equivalent security on launch day without more validator recruitment. In sharp contrast, a new Solana project like the Local Fee Market still has to bootstrap stake and governance adding months to the time-to-market.

EigenLayer has an incremental security cost of approximately 0.6 % of a project TVL, which is far lower than Solana (1.9 %) or Aptos (1.3 %, 2025 CoinMetric Models). The reuse of validators scales savings: the fifth AVS that is in the same validator cohort effectively divides the overhead five times.

Since AVSs are merely smart contracts, developers can stitch-and stitch-together components, e.g., a Stark-based prover and a threshold-EVM compute layer. This Lego approach differs with monolithic chains that many times involve porting whole runtimes.

Cross-protocol alignment is relevant when the sets of slashing conditions are shared. EigenLayer consolidates all consequences into a single ETH bond so that validators are not tempted to indulge in favoritism. Instead, independent ecosystems have to deal with security leakage, in which the validators pursue the chain that offers the greatest APY to split trust.

EigenLayer reshapes the set of validators on Ethereum into a freely tradable public good that any decent protocol can rent. Even maintaining its existing growth rate, with an exclusive doubling of active AVSs each two quarters, the industry may experience a security model under which slashing events proliferate throughout hundreds of applications, exerting never before seen discipline. Such interconnectedness could eventually match the composability breakthrough that was brought by DeFi itself in 2020. Are you a validator with new revenue in mind? A builder who is exhausted of repeating consensus? The key to the future work of many chains now lies in the realm of restaking, welcome to a mandatory primer.