Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

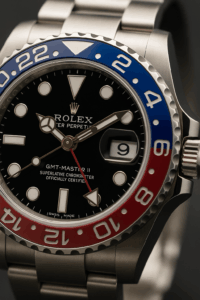

Think about it: you buy a watch to tell the time, yet years later it might be worth far more than what you paid. That’s exactly what has happened with certain Rolex models. The GMT-Master II “Pepsi,” with its red-and-blue bezel, has been in such demand since 2010 that collectors now treat it like a blue-chip stock. What makes watches like this different from other luxury goods is that they don’t just sit in a safe—they keep their value, and in many cases, grow it. Studies have shown that luxury watches often carry less risk than shares or property, while still steadily appreciating (Time is Money: An Investment in Luxury Watches, 2025). In other words, these watches don’t just look good; they pull their weight in an investment portfolio.

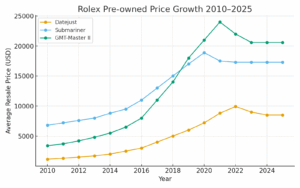

A 2025 study looked at more than 50,000 Rolex sales over 15 years. That’s not a small sample; it’s enough to see real patterns. Some models gained more than 600% in that period, others crossed the $20,000 mark in resale value. This tells us something simple: Rolex is not a fad. And unlike stocks, which rise and fall daily, watches tend to move slowly, like a steady tide (Real estate as an investment? One study says luxury watches do better, 2025). Owners can wear them, insure them, and hand them down. You can’t do that with a stock certificate.

Rolex Pre-owned Price Growth 2010–2025

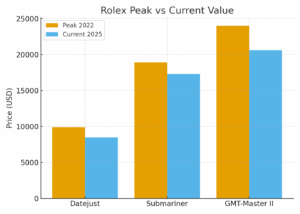

From 2020 to 2022, the pre-owned watch market was on fire. Supply chains were strained, people had extra cash, and interest in luxury goods skyrocketed. Prices for steel sports models, in particular, shot up like never before. After that peak, values cooled, but Rolex still came out ahead. Compared with many luxury goods that lost their shine, Rolex watches kept trading strongly. The correction simply separated the models with lasting appeal from those driven by hype.

Three Rolex lines have stood out as consistent winners.

The Datejust doesn’t scream for attention like a flashy sports watch, but it has quietly become the most traded Rolex from 2010 to 2025. Back in 2010, it resold for about $1,150. By mid-2025, it was closer to $8,500—an increase of 639%. Even after dipping from its 2022 high of nearly $10,000, it remains one of the most dependable performers. Models like the 16013, 16233, and 69173 keep popping up in resale charts. Its strength lies in versatility: you can wear it to a wedding or to a casual dinner, and it always looks right.

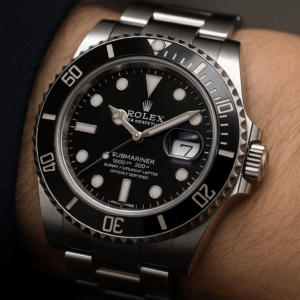

If there’s a model that defines Rolex in the eyes of collectors, it’s the Submariner. Prices start near $10,000, but the resale market tells the bigger story. In 2022, some versions peaked close to $19,000 before easing and settling around $17,295 in 2025. Popular references include 16610, 116610, and 16613. The Submariner’s appeal is straightforward—it’s tough, instantly recognizable, and has a reputation for holding value. This isn’t just hype; its steady rebound after 2023 shows staying power.

The GMT-Master II is where storytelling meets investment. The “Pepsi” and “Batman” editions are more than tools for tracking two time zones; they’re cultural icons. Since 2010, these watches have climbed over 500% in resale value. The peak came in late 2021 at almost $24,000, with current prices around $20,595. Top references include the 116710 (Batman) and 16710 (Pepsi/Coke). Collectors aren’t just buying a watch—they’re buying the history and recognition that come with it.

Rolex Peak vs Current Value (2022 vs 2025)

| Model | Average Value 2010 | Peak Value 2022 | Current Value 2025 |

|---|---|---|---|

| Rolex Datejust | $1,150 | $9,926 | $8,500 |

| Rolex Submariner | $6,800 | $18,889 | $17,295 |

| Rolex GMT-Master II | $3,400 | $23,992 | $20,595 |

SOURCE: Social Science Research Network study; Pre-owned Rolex sales report (2025).

The lesson is clear: not all watches will make you money, but certain Rolex models consistently do. The Datejust, Submariner, and GMT-Master II are the ones to watch if you’re thinking long term. For an investor, these models can act as a steady anchor, balancing out riskier parts of a portfolio. And unlike stocks that stop trading when the market closes, a Rolex keeps ticking day and night, often appreciating while you go about your life. For readers interested in exploring budget-friendly options, you can also check out o fakes for more inspiration.

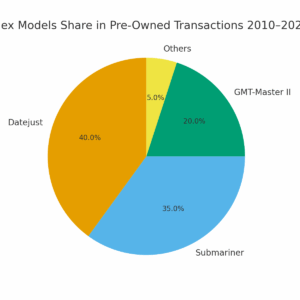

Rolex Models Share in Pre-Owned Transactions 2010–2025

Emma Reynolds, a London-based luxury asset consultant, summed it up well:

“Rolex has something few other assets can claim—it’s wearable wealth. Clients like knowing that their investment isn’t locked in a vault but on their wrist. That combination of usability and financial growth is rare.”

She added: “Don’t expect overnight gains. Think of watches as a long-distance run. Over five to ten years, the right Rolex models can quietly and reliably build value.”

James Carter is a financial journalist specializing in luxury assets and alternative investments. He has covered the global watch market for over a decade.