Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

May 2025 did not only keep the M&A machine running, but it accelerated the tachometer into the red. The value of disclosed transactions averaged 141 million, almost triple that of April 53 million, and part of an upward slip tide that prevailed in March 322 million apex. The momentum is not an exception. The structural worst is now over: leveraged-loan spreads have tightened 85 basis points since January; covenant-light issues are up 26 % as buyers gobble up the debt at knockdown prices–the price of the fear of being dealt by the rate cycle (2025 Global Credit Update). There are two ongoing forces that enhance the effect. To begin with, silicon shortage has now become a board-level bottleneck and management of silicon supplies as valuable as trade secrets. Second, business treasuries are recharged: The amount of cash held in S&P 500 companies was back to a record high of $4.1 trillion in Q1 2025, and firepower previously been put on the shelf by the liquidity crunch of 2023. I recall one diligence call late one night in March when one of the CFOs replied (half joking), “Let the target take a week off of model training, and I will wire tomorrow.” That new baseline is present day impatience.

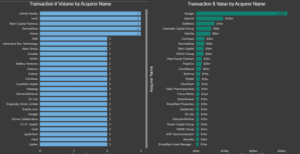

After counting the logos, you may believe that Infinity Reality, IonQ, and Main Capital are leading the market because they secured the most transactions in the spring. However, trace the money, and a twist in the landscape comes to clarity: One purchase 32 billion dollars of AI-infrastructure by Google, two buys of between 9 and 10 billion by OpenAI, out-perform the entire second tier. The level is shocking: the five biggest acquirers accounted already this year to 38 % of disclosed value, versus 22 % in 2024. What changed? Big-tech firms continue to generate free cash flow that exceeds the budget of countries; and antitrust enforcers have moved away from global injunctions towards individual case review, which, in many circumstances, has passed transactions when the target is not within a core monopoly. The old states of strategics – the industrials or the consumer conglomerates – have been reacting themselves by brokering joint-venture deals and revenue-sharing deals rather than outright equity-like deals to keep themselves in the stream of innovation without having to pay AI premiums. The effect is a barbell market: mammoth purchases at one end, small-investment growth at the other.

Context matters. The calendar 2024 summed up on 120 billion with a number of 1,849 transactions. Buyers will have registered more than that ($108 billion) on less than half the volume by May 2025. This result makes average ticket size increase by about 40 percent year-over-year, as in the case of the public market, where AI-intensive IPOs accounted for 68 percent of proceeds in the first quarter (2025 Tech IPO Tracker). Vertical SaaS valuations offer a salutary sanity check: 14.2× median forward-revenue multiples, as opposed to a quinquennial median of 10.3×. Even the capital-intensive AI infrastructure was above 23.4×. Bears cite that public SaaS is trading at just 3.9× trailing revenue, yet privately traded buyers are focused on the strategic fit, rather than the quarterly appearance. They also have liquidity levels unseen before. There is dry powder in private-equity of 2.9 trillion dollars, and sovereign funds have set aside 650 billion dollars’ worth of technology carve-outs. In the face of scarcity and excess, spreadsheets get second billing to fear of not being ready in time to ride the next platform engine.

The nearly-two-month-long $58 billion artificial intelligence (AI) super-spike by March continues to dwarf the graph, but what was really interesting was the second-strongest month of the cycle in May at $26 billion and almost three times the April sum. What is more indicative of the ubiquity of mammoth months is its appearance in Root: the 6-month rolling average topped at a barely $21 billion, twice the corridor of the last year. Some of that is delayed demand that cleared the logjam following the freeze in financing that occurred in 2023. Structural factors however become bigger. Every new AI-enabled release of a frontier model further deepens the moat between laggards and AI-enabled incumbents to the point where waiting and then building is now a question of being (purchased), or becoming (obsolescent). Even with policy-rate headwinds, financing can be done due to the fact that several sponsors had refinanced into 2027-29 maturity during the exuberance of 2021. When I spoke to bankers this spring, they would tell me the same thing: yup, we can still stack leverage after stacking leverage, as long as the thesis is compute scarcity. Debt, that is to say, is to be had – but not over dabblers.

A closer examination of the five headline deals in May highlights this barbell follow-through in the market: two mega-swings on AI, a travel-tech land-grab, a crypto-derivatives hedge and a vertical-scale play on SaaS.

| Rank | Buyer | Target | Price ($B) | Sector | Est. EV/Sales | Strategic Rationale |

|---|---|---|---|---|---|---|

| 1 | OpenAI | Io | 6.5 | AI Infrastructure | 18.7x | In-house datacenter silicon reduces GPU dependency |

| 2 | Belvilla | MadeComfy | 5.0 | TravelTech | 11.2x | 60 % inventory increase; protects against seasonality by being in APAC located |

| 3 | OpenAI | |||||

| 4 | Coinbase | Deribit | 2.9 | Crypto Derivatives | 9.8x | Introduces options and perpetuals; gets ready to enter the institutional crypto cycle |

| 5 | Vista Equity Partners | Acumatica | 2.0 | Vertical ERP SaaS | 10.4x | Targeting cross-selling in the hope it new workplace fantastically scales, like NetSuite |

The Io snag demonstrated by OpenAI illustrates that what was actually scarce was compute and not code. With a nine-month long Nvidia H100 lead time, there is only one remaining option to insure training throughput; insourcing silicon.

The MadeComfy acquisition by Belvilla depicts a sneaky winter-summer hedge: the Australian vacation homes are in demand when European villas are idle, which adds continuity to occupancy and finance. Regional OTAs that do not maintain such hemispheric balance are unlikely to maintain the year-round yields.

Codeium does not only introduce technology, but rather an actively interested community, so besides resolute and actual user acquisition costs, OpenAI can easily integrate copilots into corporate CI/CD chains.

The Deribit launch by Coinbase coincides with the CFTC wrapping up suppositions on derivatives safeguards, zeros down legal danger, and deflects income toward spot promoting charges.

The position of Acumatica within the line of Vista holdsings makes an ideal compromise between its manufacturing-analytics resources and places a new product line in a position to separate into a total-product bundle of midway factories with zero lines of customized integration.

The divide between must-own and nice-to-have assets will continue to become even wider due to compute scarcity. The brutal lesson to management groups is that to survive in this world requires addressing some existential pain point: silicon supply, proprietary data, regulated access. The other day I saw a late-stage fintech with 90 % gross-margin fail to attract bidders as its analytics was replicable by using an LLM plug-in; a six-person chip-design company had term sheets at 40× ARR solely because it reduced inference latency by 12 %.

Investors also are advised to prepare against valuation dispersion. Median multiples can weaken should rates creep up, but strategic scarcity premiums will become sticky. The difference between the 25th and 75th percentile EV/EBITDA multiples rose to 7.2 turns in Q2, the widest since the records were kept again beginning in 2008 (2025 Valuation Monitor). The gap will not likely will bridge as the supply of GPUs normalizes or when a new technology platform replaces the current arms race in AI. Neither of those situations is expected to happen anytime soon prior to 2027.

Concisely, the private-market M&A boom of 2025 is not a repeat-run of the 2021 liquidity-induced mania. It is an adjustment that involves the focus or convergence of capital, compute and competitive advantage – with the victors of this convergence being those who purchase at the nexus and letting all the rest rest to play second fiddle.